No 80C Exemption: Modi Sings Anubhavinchu Raja!

Modi Sings Anubhavinchu Raja!

"You maybe alive today. But then, who knows what happens to you tomorrow? So, forget all the hardships. You expend every penny of yours, right now! Never think of saving your money. It's merely a futile exercise. Why do you hesitate? Come on!! Sing the song, "Anubhavinchu Raja...anubhavinchu raja... puttindee...perigindee..endukoo? Anduke." This is the message what BJP appeared to have conveyed the nation with its Income Tax amendments.

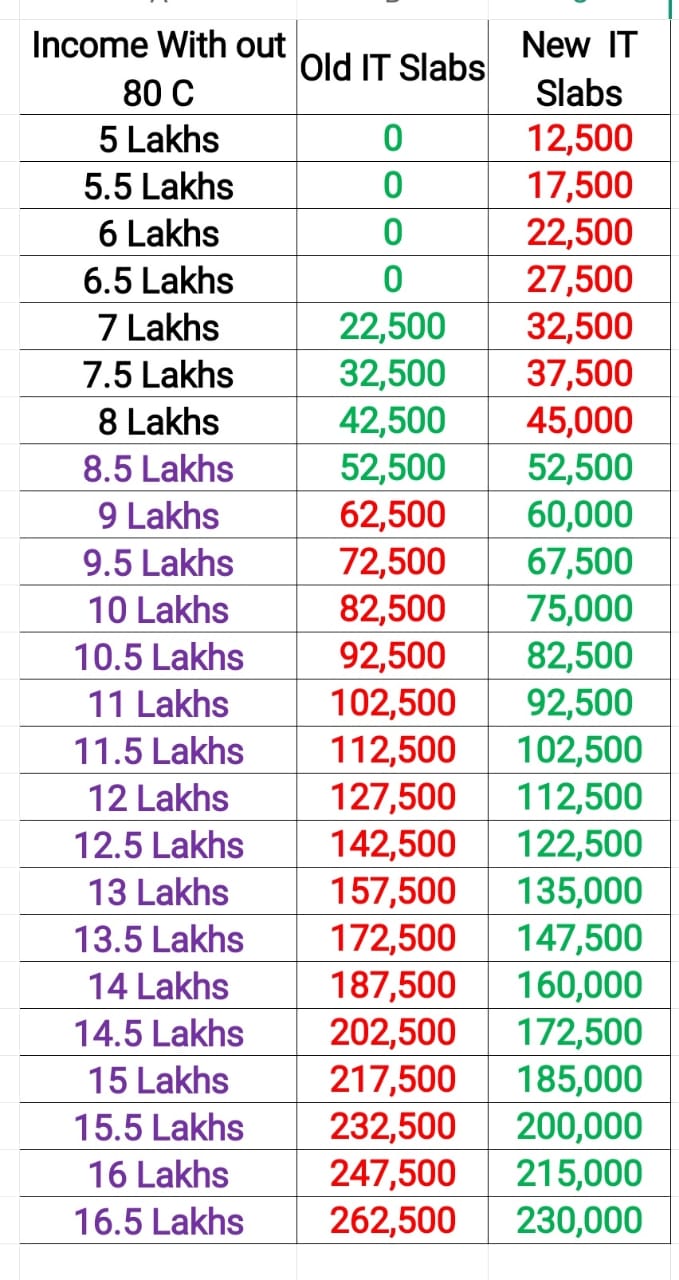

The IT slabs have been extended to seven from four. There was a considerable depreciation in the proposed rates. The rates will come down from 20% to 10% for the taxable income between Rs.5 lakh and Rs.7.5 lakh. The proposed rates for the taxable income between Rs.7.5 lakh to Rs.10 lakh will be 15% while it will be 20% for the income group between Rs.10 lakh and Rs.12.5 lakh. The rate is fixed to 25% for the taxable income between Rs.12.5 lakh to Rs.15 lakhs. It will be 30% rate for the income that crosses Rs.15 lakhs.

Broadly, it appears the union financial ministry has done great favour to the salaried. Sadly, nothing of that sort will be happening in reality. The government gave a huge jolt to the salaried removing 80C exemptions.

As is known, several savings such as LICs, PPF/GPFs etc.come under 80C exemptions. Furthermore, housing loan interest exemptions will also be axed in the new tax proposals. Having gone through the above table it's clearly made out the kind of damage done to middle class group.

Thank God!! Nirmala madam at least has done a small favour ensuing the new tax proposals as optional that paves way for applying IT returns with the previous IT scheme.

Ala Breaches Mega Milestone in the US

Ala Breaches Mega Milestone in the US Pawan 3 Films: Shivers to Politicians

Pawan 3 Films: Shivers to Politicians